How utilities can avoid cutting power to delinquent—and vulnerable—households

By Peter Londa, CEO, Tantalus

No one wants to cut power to someone’s home, particularly those who are struggling to pay their bills.

But as the COVID-19 pandemic and its economic fallout show little sign of turning any corner as we transition to colder temperatures and winter climates, utilities throughout North America are grappling with a growing number of customers who have fallen into arrears. And no organization, no matter how resilient, can continue operating without collecting outstanding bills indefinitely or relying on stimulus grants or allocations from hardship funds at the State and Federal level.

This is a growing crisis. As of this past July, approximately 800,000 low-income households had their power disconnected, with millions more at risk. It’s a problem that will only get worse as the pandemic and its economic impact continue to linger into 2021. While an increasing number of households struggling to pay power bills is a challenge for any utility, this growing crisis is particularly difficult for public power and electric cooperative utilities, which often serve the hardest-hit communities. These utilities need to collect in order to keep the lights on and support their communities.

As the CEO of Tantalus, this crisis hits home on a personal level. I know the people who manage these public power and electric cooperative utilities and have visited the vital communities they serve. Our company has been committed to serving this market segment for more than 30 years, and I speak with the leaders of these utilities regularly about the impact COVID-19 is having on their business and communities. These are well-intentioned people stuck in tough situations. They don’t want to have to disconnect the power to people who cannot truly pay their bills. But if their only other option is to leave the meters running … it’s a tough choice.

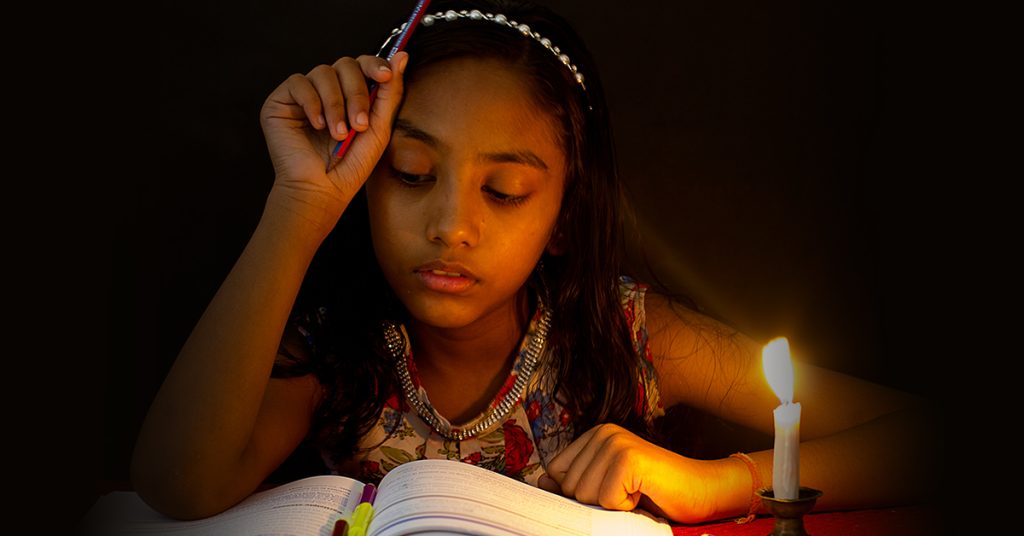

That choice gets even tougher when you see how badly many people are hurting. We’ve all seen them on the news and read their stories. These are some of the most vulnerable members of our society. Many have medical conditions and need to refrigerate medication or power medical devices. Many are elderly and frail, and could succumb to extreme heat or cold temperatures. Many still have kids attending school remotely and need to power laptops and access reliable Internet access. We’re talking about decent people who were already struggling to make ends meet before the pandemic hit, but were getting by. Now, through no fault of their own, they’re out of work, deeper in debt and have fallen behind on their bills.

Until recently, utilities have only had one tool to force people to pay their past-due balances: shutting the power off.

For many, that threat is not immediate. Twenty-two states, including the District of Columbia, continue to maintain a moratorium against cutting power to customers during this time. And with winter almost here, many other severe-weather states will put a pause on power shutoffs. But eventually, these restrictions will be lifted. Eventually, the bills will come due, and every utility could be faced with thousands of customers who owe them money, have limited means to pay and still desperately need power for their homes.

But then what? Many of the public power and electric cooperative leaders I speak with dread having to make an impossible choice—try to swallow bad debt and put their own utilities at risk, await stimulus grants or access to hardship funds from the government or cut power to people who can least afford an interruption in service.

Fortunately, the choice doesn’t have to be that stark. With an ingenious combination of technology solutions including load limiting, service limiting, pre-pay and the use of data analytics, many pioneering utilities are innovating their way out of this dilemma.

Take, for example, Northeastern REMC, Indiana’s third largest electric distribution cooperative serving six counties across more than 600 square miles—and a Tantalus customer. As Indiana’s pandemic moratorium extended through the summer, the utility had more than 500 customers in arrears. And yet, as autumn began, they were able to get all of these customers back in good standing by leveraging connected and controllable devices and implementing payment plans through software tools.

“We stayed engaged with customers who were falling behind throughout the moratorium,” explains Andrew Mitchell, an Engineering Supervisor at Northeastern REMC. “And we had a plan to engage with them once it was lifted, in a respectful and conscientious manner. We were not seeking to be punitive, but rather find a way to maintain service while providing a path for our members to be in good-standing.”

Mitchell and his colleagues at Northeastern were not required to roll a single truck or cut power to any households in their service territory due to outstanding bills resulting from COVID-19. Instead, they used a comprehensive network of connected devices accessing granular data from their Tantalus smart grid system to protect their community and keep their balance sheet healthy.

And it’s a playbook that’s rapidly gaining in popularity as the crisis lingers. Here’s how these options work:

Load Limiting

Through the use of connected meters and software tools, utilities may define certain levels of service to those who are past due. This level of service will power vital features of a household, such as the refrigerator, a medical device, or limited heating or cooling. If the household goes above this agreed-upon level, the power is shut off for a brief period of time, then resets and comes back online at the load limit. This solution is an option that allows households in arrears to maintain vital electric service for their needs as they get back on their feet, and in a position to pay their bill fully and restore full power.

Service Limiting

Service Limiting is a solution that was developed in conjunction with a utility in Minnesota which is prohibited from disconnecting power during the winter months due to extreme and frigid temperatures. This feature is distinct from Load Limiting in that the utility delivers its full power service to a household at the usual level but then disconnects power for a defined period of time.

Pre-Pay

By putting customers more in control of their debt payment, a Pre-Pay system incentivizes households to stay current. Through this solution, customers opt into a program in which they pre-pay an amount that the utility draws against, and can track their status on a mobile app. They can also set their own limits, utilizing Load Limiting, in order to reduce their bill and make their funds last longer. With payment plans self-managed by the customer through Pre-Pay, utilities can decrease these large arrearages over time without having to cut service completely.

To bring its more than 500 delinquent customers out of debt and out of the threat of a power cutoff, Northeastern utilized consistent communication and a Pre-Pay program. Emails, text messages and phone calls were sent during the moratorium, and as it was lifted, physical door knocker announcements were placed at households, encouraging these customers to contact the utility. Most members settled their accounts as the moratorium lifted to avoid losing power services. The remaining 150 households experiencing financial hardship entered into the Pre-Pay program, without any family losing power.

As the Engineering Supervisor at Northeastern REMC, Mitchell believes his team proactively worked through a difficult challenge while simultaneously supporting their members and surrounding community. “We could have been punitive, and effectively disconnected power to people’s homes, but that’s not the way to treat our members,” says Mitchell. “And we’re trying to encourage people to keep this up as Indiana’s winter moratorium kicks in at the end of November. We don’t want them coming out of that moratorium in March with large unpaid bills.”

The solutions and example outlined above are humane and respectful ways for utilities to engage with their customers who are in arrears. They put no one’s health at risk, and they make good business sense. Best of all, they are software-driven, leveraging the data supplied by Tantalus’ smart grid solutions.

To get through this unprecedented national and global challenge, we need to look out for one another as best we can. Public power and electric cooperative utilities have a role to play in how communities pull together. Many are already stepping up to help impacted customers keep their electricity on and enlist in payment plans. The most vulnerable among us need help—not a handout – and definitely not the punishment of losing vital household power due to no fault of their own. Data-driven software solutions empower utilities to treat their customers and members in a humane and respectful manner to help individuals steady their households and retain their dignity. It’s the right thing to do in times like these, and the right thing to do going forward.

To learn more about how Tantalus can help utilities resolve their debt loads and help vulnerable customers, visit www.tantalus.com or contact us at TantalusInfo@tantlalus.com.