Delivers record results for revenue generated during a first quarter and orders converted in a quarter

Burnaby, BC – May 9, 2023 – Tantalus Systems (TSX: GRID) (“Tantalus” or the “Company”), a smart grid technology company focused on helping build sustainable utilities for the future, is pleased to announce its financial and operating results for the quarter ended March 31, 2023.

Financial Highlights for Q1[1]:

- Revenue: Generated $10.4 million (CND$14.1 million), representing 12% growth over the prior year period. This revenue amount sets a record for the Company in terms of revenue generated during a first quarter. Revenue from the Utility Software Applications and Services segment represented 32% of total revenue in the quarter.

- Annual Recurring Revenue (ARR)[2]: Grew approximately 22% to $10.0 million (CND$13.6 million) as compared to $8.2 million (CND$10.4 million) from the prior year period. ARR recognized in the quarter represented 23% of total revenue generated in the quarter.

- Gross Profit[2] Margin: Remained fairly constant at 47% compared to 48% over the prior year period.

- Adjusted EBITDA[2]: Delivered negative $0.7 million (negative CND$0.9 million) as compared to negative $0.7 million (negative CND$0.9 million) for the prior year period. While the numbers are similar, Q1 of 2022 did not include a full quarter of expenses from Congruitive, which was acquired in February 2022. The negative Adjusted EBITDA in the quarter was primarily tied to the ongoing R&D effort to commercialize the TRUSense™ Gateway product offering.

- Total Assets: Ended the quarter with $38.9 million (CND$52.6 million) as compared to $37.4 million (CND$50.7 million) as of December 31, 2022.

- Sales Orders: The Company converted $17.7 million (CND$24.0 million) from our sales pipeline in Q1, setting a new milestone for orders converted within a quarter. The previous milestone of $16.0 million (CND$21.6 million) was set in Q1 of 2022. In addition, the Company also added 7 new utilities during the quarter to grow its User Community to 278 utilities.

“We continue to build momentum and are pleased with the progress made during Q1,” said Peter Londa, President & CEO of Tantalus. “Delivering new financial and commercial milestones are a direct result of the dedication and hard work of our entire team. We continue to invest in the development of the TRUSense Gateway and our AI-enabled Transformer Analytics offering, both of which will enable utilities to modernize their distribution grids. In validating the differentiation of these two major R&D initiatives at our recent Users Conference, we believe Tantalus is well-positioned for the future.”

The Company will hold a conference call and webcast to discuss the financial results on Wednesday, May 10, 2023, at 11:00 am Eastern Time.

Conference Call

Participant Dial In (Toll Free): 1-844-854-4410

Participant International Dial In: 1-412-317-5791

Webcast

Webcast URL: https://event.choruscall.com/mediaframe/webcast.html?webcastid=1P9zYXYX

Replay Information

A conference call and webcast replay will be available until May 17, 2023. To access the conference call replay, please see details below:

US Toll Free: 1-877-344-7529

International Toll: 1-412-317-0088

Canada Toll Free: 1-855-669-9658

Replay Access Code: 9455841

Financial Statements and Management Discussion & Analysis

Please see the Company’s consolidated financial statements (“Financial Statements”) and related Management’s Discussion & Analysis (“MD&A”) for more details. The Financial Statements for the three months ended March 31, 2023, and related MD&A have been reviewed and approved by Tantalus’ Audit Committee and Board of Directors. For a more detailed explanation and analysis, please refer to the MD&A that has been filed on SEDAR at www.sedar.com and is also available on the Company’s website at www.tantalus.com.

Non-IFRS and Other Financial Measures

This press release refers to the following non-IFRS measures:

“EBITDA” is comprised as income (loss) less interest, income tax and depreciation and amortization. Management believes that EBITDA is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company. “Adjusted EBITDA” is comprised as income (loss) less interest, income tax, depreciation, amortization, stock-based compensation, foreign exchange gain (loss) and other income / expenses not attributable to the operations of the Company. Management believes that Adjusted EBITDA is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company. See “Reconciliation of Net (Loss) / Income to Adjusted EBITDA” for a quantitative reconciliation of Adjusted EBITDA to the most directly comparable financial measure.

“Gross Profit” is comprised as the Company’s revenues less cost of sales. Management believes that Gross Profit is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company. See “Gross Profit Reconciliation” for a quantitative reconciliation of Gross Profit to the most directly comparable financial measure. This press release refers to “Gross Profit Margin” which is a non-IFRS ratio. Gross Profit Margin is comprised of Gross Profit expressed as a percentage of the Company’s revenues. Management believes that Gross Profit Margin is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company.

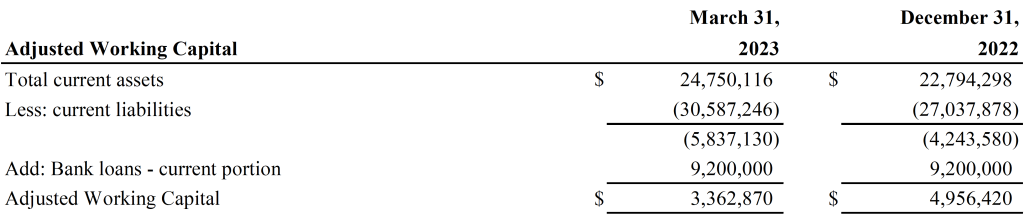

“Adjusted Working Capital” is comprised as current assets less current liabilities exclusive of the Company’s bank loan. Management believes Adjusted Working Capital is a useful indicator for investors, and is used by management, for evaluating the operating liquidity to the Company. See “Adjusted Working Capital Reconciliation” for a quantitative reconciliation of Adjusted Working Capital to the most directly comparable financial measure.

“Recurring Revenue” is comprised of the Company’s revenues that are recurring in nature and attributable to its analytics and other software as a service (“SaaS”) offering, hosting services and software maintenance and technical support agreement services. “Annual Recurring Revenue” or “ARR” is comprised of the Company’s Recurring Revenue as expressed on an annualized revenue basis attributable to its customer agreements at a point in time.

Such non-IFRS measures and non-IFRS ratio do not have a standardized meaning under IFRS and may not be comparable to a similar measure disclosed by other issuers.

Gross Profit Margin Reconciliation

Reconciliation of Net (Loss)/Income to Adjusted EBITDA

(a) Finance expense comprised of interest and related finance expense on bank loans and lease liabilities.

(b) Share-based non-cash compensation expense.

(c) Foreign exchange comprised of unrealized (gain) / loss from non-functional currency assets and liabilities.

(d) General and administrative expenses pertaining to the Company’s acquisition of Congruitive.

Adjusted Working Capital Reconciliation

About Tantalus Systems Holding Inc. (TSX: GRID)

Tantalus is a smart grid technology company that transforms aging one-way grids into future-proofed multi-directional grids that improve the efficiency, reliability and sustainability of utilities and the communities they serve. Our solutions are purpose-built to allow utilities to restore power quickly after major disruptions, adapt to rapidly shifting consumer expectations and population shifts, innovate new solutions based on the adoption of distributed energy resources and evolve their grid infrastructure at their own pace without needless cost or complexity. All this gives our user community the flexibility they need to get the most value from existing infrastructure investments while planning for future requirements. Learn more at www.tantalus.com.

Forward-Looking Statements:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes statements such as those relating to: increasing demand for the Company’s solutions going forward, the adoption, performance and development of the Company’s solutions, such as the TRUSense Gateway and data analytics (including AI-enabled Transformer Analytics), and the benefits of investment in related R&D initiatives to support and accelerate growth for the Company.

To the extent any forward-looking information in this news release constitutes a “financial outlook” within the meaning of securities laws, such information is being provided because management’s estimate of the future financial performance of Tantalus is useful to investors, and readers are cautioned that this information may not be appropriate for any other purpose and that they should not place undue reliance on such information.

In connection with the forward-looking information contained in this news release, Tantalus has made numerous assumptions, regarding, among other things: the expected impact of COVID-19, the expected impact of supply chain constraints, the expected impact of inflationary pressures on costs and the expected timing of new product introductions. While Tantalus considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies. Additionally, there are known and unknown risk factors which could cause Tantalus’ actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. A complete discussion of the risks and uncertainties facing Tantalus is disclosed under the heading “Risk Factors” in the Tantalus’ Annual Information Form dated March 31, 2023, as well as those risk factors included with Tantalus’ continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Tantalus disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

Contact Tantalus:

Deborah Honig

Investor Relations

647-203-8793 | deborah@adcap.ca

Website: www.tantalus.com

LinkedIn: LinkedIn/company/tantalus

Twitter: @TantalusCorp

[1] Financial information is reported in United States dollars (“$”) unless otherwise stated and in accordance with International Financial Reporting Standards (“IFRS”). Where balances are also expressed in Canadian dollars in this press release, an average foreign exchange rate of 0.7369 for the three months ended March 31, 2023 (0.7898 for three months ended March 31, 2022) for income statement items and a foreign exchange rate of 0.7389 as at March 31, 2023 (and 0.8003 as at March 31, 2022 and 0.7383 as at December 31, 2022) for balance sheet items has been applied.

[2] See “Non-IFRS and Other Financial Measures.”