Burnaby, BC – March 23, 2022 – Tantalus Systems (TSX: GRID) (“Tantalus” or the “Company”), a smart grid technology company focused on helping build sustainable utilities for the future, is pleased to announce its financial results for the fourth quarter and year ended December 31, 2021.

“2021 was a historic year for Tantalus as we successfully migrated to the public markets, secured over CAD$20 million through two financings and continued to witness strong growth in our user community of utilities throughout the year,” said Peter Londa, President & CEO of Tantalus. “During 2021, we delivered year-over-year growth of 27.5% in orders from our sales pipeline, expanded our user community to over 210 utilities by adding 25 new customers and launched our first AI-enabled data analytics tool to help utilities improve their resiliency. Looking forward to 2022, we anticipate strong revenue growth with approximately US$27 million in backlog that is expected to be shipped during the year. We are also witnessing strong secular drivers that are motivating utilities to modernize their distribution grids.”

Extreme weather continues to challenge the resiliency of distribution grids while the availability and accelerating adoption of electric vehicles is stressing existing grid infrastructure by increasing the amount of power consumers require, changing the location where electricity needs to be delivered and altering the timing of peak load profiles that utilities are required to manage. Coupled with investments being made by homeowners and businesses to install roof-top solar panels that are expected to deliver power from the edge of the grid, the utility industry is facing an unprecedented number of challenges that require upgrades to distribution grids across North America. “These challenges create urgency among utilities to digitize their grids. By doing so, utilities gain situational awareness and the necessary command and control of critical assets,” said Mr. Londa. “Our strong balance sheet enabled us to execute the recently announced acquisition of Congruitive which places Tantalus at the forefront of helping utilities prepare for the significant impact that electric vehicles and distributed energy resources will have on their resiliency and reliability.”

Q4, 2021 and Year-to-Date Financial Summary

(Financial information is reported in United States dollars (“$”) unless otherwise stated and in accordance with International Financial Reporting Standards (“IFRS”)).

Key financial results for the quarter are compared to the same timeframe in the previous year unless otherwise stated.

- The Company reported revenue of $6 million for Q4, 2021 as compared to $9.3 million for the prior year quarter and $32.2 million during the twelve months of 2021 compared to $33.0 million for 2020. The decline in revenue was directly tied to supply chain constraints and shipping delays of contracted revenue in 2021 that has been delayed into 2022.

- The Company reported Gross Profit[1] of $4 million representing a Gross Profit margin of 44% for Q4, 2021 as compared to $4.8 million and a Gross Profit margin of 52% for the prior year quarter. The decline in Gross Profit and Gross Profit margin was due to increasing costs associated with supply chain constraints and logistics, delayed revenue moving out of 2021 and into 2022 and the mix of products sold during the quarter. Gross Profit reported for the twelve months of 2021 was $14.4 million representing Gross Profit Margin of 45% as compared to $16.1 million and 49% for 2020.

- The Company reported Adjusted EBITDA[2] of ($1.27 million) in Q4, 2021 as compared to $0.82 million in the prior year quarter and ($73 million) for the year ended December 31, 2021 as compared to $2.63 million in 2020. The decline in Adjusted EBITDA was primarily due to the absorption of public company expenses incurred during 2021 for the first time and the loss of SR&ED credits in 2021. The Company also witnessed increased costs across its supply chain.

- The Company had total assets of $31.0 million as at December 31, 2021, inclusive of $14.2 million in cash, compared to $23.5 million as at December 31, 2020, inclusive of $4.6 million in cash.

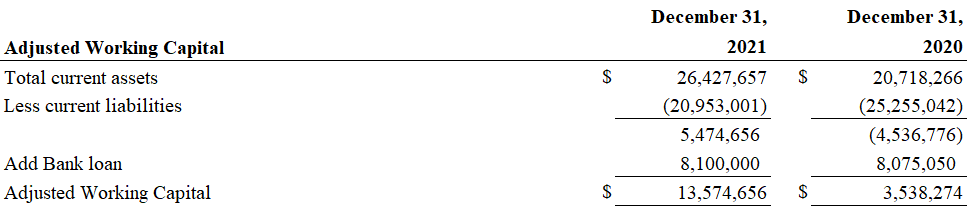

- The Company had Adjusted Working Capital[3] as at December 31, 2021 of $13.6 million compared to $3.5 million as at December 31, 2020.

Operating Highlights for the Fourth Quarter of 2021

- Growth of Tantalus’ User Community: Tantalus increased its customer base to over 210 utilities with the addition of 7 new utilities during Q4, 2021 and a total of 25 new utilities for the twelve months of 2021. The Company surpassed 2.8 million endpoints shipped, collecting more than 30 billion data points related to energy consumption and power quality. Within its existing user community, the Company has over 1.6 million available endpoints to deploy in the future that will drive revenue and access to additional data for its expanding software and analytics packages.

- Release of Tantalus Grid Reliability Analytics (“TGRA”): Tantalus introduced its first AI-enabled data analytics solution to improve the resiliency of utilities. The TGRA solution utilizes algorithms to continuously monitor power-quality data accessed by TRUEdge®-enabled endpoints on Tantalus’ TUNet® smart grid platform. By detecting anomalies in power quality, the solution identifies symptoms of failing transformers, corroded meter sockets and splices, cracked insulators and other latent equipment problems. The analytics solution leverages data from Tantalus’ AMI system to provide utilities with visibility into power quality issues that lead to outages and premature failure of devices deployed across the distribution grid. After launching the first commercial version of TGRA in September, 2021, the Company secured its first six utilities from the existing user community that have subscribed to a Software-as-a-Service (SaaS) offering.

- Introduction of a Next-Generation Fiber Gateway: Tantalus initiated the development effort of the recently announced TRUSense™ Fiber Gateway, a next-generation Fiber-to-the-Home (“FTTH”) solution that is intended to enable utilities to leverage investments in fiber to not only improve the resiliency of their distribution grids but also address the broadband divide that surfaced during the COVID-19 pandemic by delivering broadband services to consumers. The TRUSense Gateway will also serve as the basis for Tantalus to enable utilities to go behind the meter to access and control electric vehicle charging stations, solar inverters and other intelligent devices inside premises. To increase awareness and to accelerate our business development activities, Tantalus announced a partnership with Irby Utilities which will broaden Tantalus’ sales channel to drive market adoption.

Strong Momentum Heading Into 2022

- Revenue Guidance: The Company anticipates growing revenue year-over-year by 20% to 25% in 2022, targeting approximately $38.6 to $40.2 million in 2022. This guidance includes revenue contributions from the recent acquisition of Congruitive and is based on the Company’s existing backlog to be recognized in 2022 of approximately $27 million.

- Acquisition of Congruitive: The addition of Congruitive places Tantalus at the forefront of helping utilities modernize their systems by seamlessly integrating electric vehicles (“EVs”) and distributed energy resources (“DERs”) to improve the resiliency and reliability of distribution grids. Congruitive translates data across multiple devices and platforms allowing utilities to operate smart grids as one intelligent and secure system. The Company anticipates that the demand for this solution will grow significantly as EV and DER adoption continues to expand rapidly. In addition to broadening Tantalus’ solutions, the acquisition of Congruitive also enables the Company to pursue investor-owned utilities (IOUs) and additional verticals, thereby increasing the Company’s total addressable market opportunity.

- Stimulus Funding: Tantalus is actively leading an effort to support current and prospective utility customers with the submission of applications to access funding across several programs being offered by the US federal government, including the ARPA and BRIC programs. For more information, please go to the Company’s website (https://tantalus.com/resources/funding/).

While the growth horizon remains favorable for Tantalus, management is mindful of the ongoing worldwide disruption to the availability of electronic components, particularly with respect to semiconductors, and is actively implementing appropriate strategies to mitigate disruptions to project deployments. Management is also prioritizing the health and safety of Tantalus’ employees due to the continued impact of the COVID-19 pandemic. Additionally, Tantalus is actively managing inflationary pressures that may impact costs across our business.

The Company will hold a conference call and webcast to discuss the financial results on Wednesday, March 23, 2022 at 2:00 p.m. Eastern Time.

Conference Call

Participant Dial In (Toll Free): 1-844-854-4410

Participant International Dial In: 1-412-317-5791

Webcast

https://services.choruscall.com/mediaframe/webcast.html?webcastid=tgsu6HTG

Replay Information

A conference call replay will be available until March 31, 2022. The webcast will be available until March, 23, 2023 at the link set out above. To access the conference call replay, please see details below:

US Toll Free: 1-877-344-7529

International Toll: 1-412-317-0088

Canada Toll Free: 1-855-669-9658

Replay Access Code: 5067892

Financial Statements and Management Discussion & Analysis

Please see the consolidated financial statements (“Financial Statements”) and related Management’s Discussion & Analysis (“MD&A”) for more details. The consolidated financial statements for the year ended December 31, 2021 and related MD&A have been reviewed and approved by Tantalus’ Audit Committee and Board of Directors. For a more detailed explanation and analysis, please refer to the MD&A that has been filed on SEDAR at www.sedar.com and is also available on the Company’s website at www.tantalus.com.

About Tantalus Systems Holding Inc. (TSX: GRID)

Tantalus is a smart grid technology company that transforms aging one-way grids into future-proofed multi-directional grids that improve the efficiency, reliability and sustainability of public power and electric cooperative utilities and the communities they serve. Our solutions are purpose-built to allow utilities to restore power quickly after major disruptions, adapt to rapidly shifting consumer expectations and population shifts, innovate new solutions based on the adoption of distributed energy resources and evolve their grid infrastructure at their own pace without needless cost or complexity. All this gives our user community the flexibility they need to get the most value from existing infrastructure investments while planning for future requirements. Learn more at www.tantalus.com.

Non-IFRS and Other Financial Measures

This press release refers to the following non-IFRS measures:

“EBITDA” is comprised as income (loss) less interest, income tax and depreciation and amortization. Management believes that EBITDA is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company. See “Reconciliation of Net (Loss) / Income to Adjusted EBITDA” for a quantitative reconciliation of EBITDA to the most directly comparable financial measure. “Adjusted EBITDA” is comprised as income (loss) less interest, income tax, depreciation, amortization, stock-based compensation, foreign exchange gain (loss) and other income / expenses not attributable to the operations of the Company. Management believes that EBITDA is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company. See “Reconciliation of Net (Loss) / Income to Adjusted EBITDA” for a quantitative reconciliation of Adjusted EBITDA to the most directly comparable financial measure.

“Gross Profit” is comprised as the Company’s revenues less cost of sales. Management believes that Gross Profit is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company. See “Gross Profit Reconciliation” for a quantitative reconciliation of Gross Profit to the most directly comparable financial measure. This press release refers to “Gross Profit Margin” which is a non-IFRS ratio. Gross Profit Margin is comprised of Gross Profit expressed as a percentage of the Company’s revenues. Management believes that Gross Profit Margin is a useful indicator for investors, and is used by management, in evaluating the operating performance of the Company.

“Adjusted Working Capital” is comprised as current assets less current liabilities exclusive of the Company’s bank loan. Management believes Adjusted Working Capital is a useful indicator for investors, and is used by management, for evaluating the operating liquidity to the Company. See “Adjusted Working Capital Reconciliation” for a quantitative reconciliation of Adjusted Working Capital to the most directly comparable financial measure.

Such non-IFRS measures and non-IFRS ratio do not have a standardized meaning under IFRS and may not be comparable to a similar measure disclosed by other issuers.

Gross Profit Reconciliation

Reconciliation of Net (Loss) / Income to Adjusted EBITDA

- Finance expense comprised of interest and related finance expense on bank loan and lease liabilities (see Financial Statements).

- Stock-based compensation comprised of non-cash compensation (see Financial Statements).

- Foreign exchange comprised of unrealized loss from non-functional currency assets and liabilities (see Financial Statements).

- Other income comprised of the gain on Energate Inc. acquisition arbitration share cancellation and government assistance benefit received pertaining to the COVID-19 Pandemic (see Financial Statements inclusive of note 21).

- General and administrative expenses pertaining to the Company’s acquisition of Congruitive completed on January 31, 2022 (see notes 20 and 25 to the Financial Statements).

- General and administrative expenses pertaining to the Company’s acquisition of Energate Inc. arbitration (see notes 14(g) and 20 of the Financial Statements).

- Reverse acquisition listing expense comprised of excess purchase price over RiseTech Capital Corp. net assets acquired (see notes 4 and 20 in the Financial Statements).

- Reverse acquisition costs comprised of legal and professional fees (see notes 4 and 20 in the Financial Statements).

Adjusted Working Capital Reconciliation

Forward-Looking Statements:

This news release contains “forward-looking information” within the meaning of applicable securities laws. Forward-looking information is generally identifiable by use of the words “believes”, “may”, “plans”, “will”, “anticipates”, “intends”, “could”, “estimates”, “expects”, “forecasts”, “projects” and similar expressions, and the negative of such expressions. Forward-looking information in this news release includes statements such as: we anticipate strong revenue growth with approximately US$27 million in backlog that is expected to be shipped during the year; we are also witnessing strong secular drivers that are motivating utilities to modernize their distribution grids; the recently announced acquisition of Congruitive which places Tantalus at the forefront of helping utilities prepare for the significant impact that electric vehicles and distributed energy resources will have on their resiliency and reliability; the Company has over 1.6 million available endpoints to deploy in the future that will drive revenue and access to additional data for its expanding software and analytics packages; ; the Company anticipates growing revenue year-over-year by 20% – 25% in 2022, targeting approximately $38.5 to $40.0 million in 2022; demand for the Congruitive solution is expected to grow significantly as EV and DER adoption continues to expand rapidly in 2022; and, the acquisition of Congruitive also enables Tantalus to pursue investor-owned utilities (IOUs) and additional verticals, thereby increasing the Company’s total addressable market opportunity.

To the extent any forward-looking information in this news release constitutes a “financial outlook” within the meaning of securities laws, such information is being provided because management’s estimate of the future financial performance of Tantalus is useful to investors, and readers are cautioned that this information may not be appropriate for any other purpose and that they should not place undue reliance on such information.

In connection with the forward-looking information contained in this news release, Tantalus has made numerous assumptions, regarding, among other things: the expected impact of COVID-19 and the expected timing of new product introductions. While Tantalus considers these assumptions to be reasonable, these assumptions are inherently subject to significant uncertainties and contingencies. Additionally, there are known and unknown risk factors which could cause Tantalus’ actual results, performance or achievements to be materially different from any future results, performance or achievements expressed or implied by the forward-looking information contained herein. A complete discussion of the risks and uncertainties facing Tantalus is disclosed under the heading “Risk Factors” in the Tantalus’ Annual Information Form dated March 23, 2022, as well as those risk factors included with Tantalus’ continuous disclosure filings with Canadian securities regulatory authorities available at www.sedar.com. All forward-looking information herein is qualified in its entirety by this cautionary statement, and Tantalus disclaims any obligation to revise or update any such forward-looking information or to publicly announce the result of any revisions to any of the forward-looking information contained herein to reflect future results, events or developments, except as required by law.

[1] See “Non-IFRS and Other Financial Measures”.

[2] See “Non-IFRS and Other Financial Measures”.

[3] See “Non-IFRS and Other Financial Measures”.