Not for distribution to United States newswire services or dissemination in the United States

Burnaby, British Columbia – May 8, 2024 – Tantalus Systems Holding Inc. (TSX: GRID) (“Tantalus” or the “Company”) is pleased to announce that it has entered into an agreement with a syndicate of investment dealers led by Cormark Securities Inc. and Canaccord Genuity Corp. (collectively, the “Underwriters”) pursuant to which the Underwriters have agreed to purchase, on a bought deal private placement basis, 6,250,000 common shares (the “Common Shares”) from the treasury of the Company, at a price of C$1.60 per Common Share for total gross proceeds of approximately C$10 million (the “Offering”).

The Offering will consist of 4,937,500 Common Shares issued pursuant to the listed issuer financing exemption available under Part 5A of National Instrument 45-106 – Prospectus Exemptions (“NI 45-106”) in each of the provinces of Canada, other than Quebec, for maximum gross proceeds of $7,900,000 (the “LIFE Tranche”). There is an offering document relating to the LIFE Tranche that can be accessed under the Company’s profile at www.sedarplus.ca and at the Company’s website at www.tantalus.com. Prospective investors should read this offering document before making an investment decision.

In addition, the Company will complete, concurrent with the LIFE Tranche, a brokered private placement of 1,312,500 Common Shares on the same terms as the LIFE Tranche, for gross proceeds of $2,100,000 (the “Concurrent Private Placement Tranche”). The Common Shares sold under the Concurrent Private Placement Tranche will be sold pursuant to applicable exemptions under NI 45-106 other than the listed issuer financing exemption. The Life Tranche together with the Concurrent Private Placement Tranche will constitute the Offering.

The net proceeds of the Offering shall be used for research and development activities pertaining to new product initiatives, sales and business development activities and general corporate purposes and working capital.

The Offering is expected to close on or about May 23, 2024, or such other date as the Company and the Underwriters may agree and is subject to certain conditions including, but not limited to, the receipt of all necessary regulatory and other approvals including the acceptance of the Toronto Stock Exchange.

The Company will pay a fee in connection with the Offering comprised of (i) a cash fee equal to 6.0% of the aggregate gross proceeds of the Offering (“Cash Commission”), and (ii) an aggregate number of compensation warrants (each, a “Compensation Warrant”) equal to 6.0% of the aggregate number of Common Shares issued pursuant to the Offering. Each Compensation Warrant will be exercisable to acquire one Common Share at an exercise price equal to the offering price for a period of 24 months from the closing date, subject to adjustment in certain events. Each of the Cash Commission payable and Compensation Warrants issuable to the Underwriters will be reduced to 3% with respect to certain purchasers identified on the Company’s president’s list.

All securities issued in connection with the LIFE Tranche are expected to be immediately freely tradeable under applicable Canadian securities laws if sold to purchasers resident in Canada. All securities issued in connection with the Concurrent Private Placement Tranche and the Compensation Warrants and underlying Common Shares will, where applicable, be subject to a statutory hold period of four months and one day following the date of issuance in accordance with applicable Canadian securities laws.

This press release shall not constitute an offer to sell or the solicitation of an offer to buy nor shall there be any sale of the securities in any jurisdiction in which such offer, solicitation or sale would be unlawful prior to registration or qualification under the securities laws of any such jurisdiction. This press release does not constitute an offer of securities for sale in the United States. The securities being offered have not been, nor will they be, registered under the United States Securities Act of 1933, as amended, and such securities may not be offered or sold within the United States absent registration under U.S. federal and state securities laws or an applicable exemption from such U.S. registration requirements.

ABOUT TANTALUS SYSTEMS HOLDING INC. (TSX: GRID)

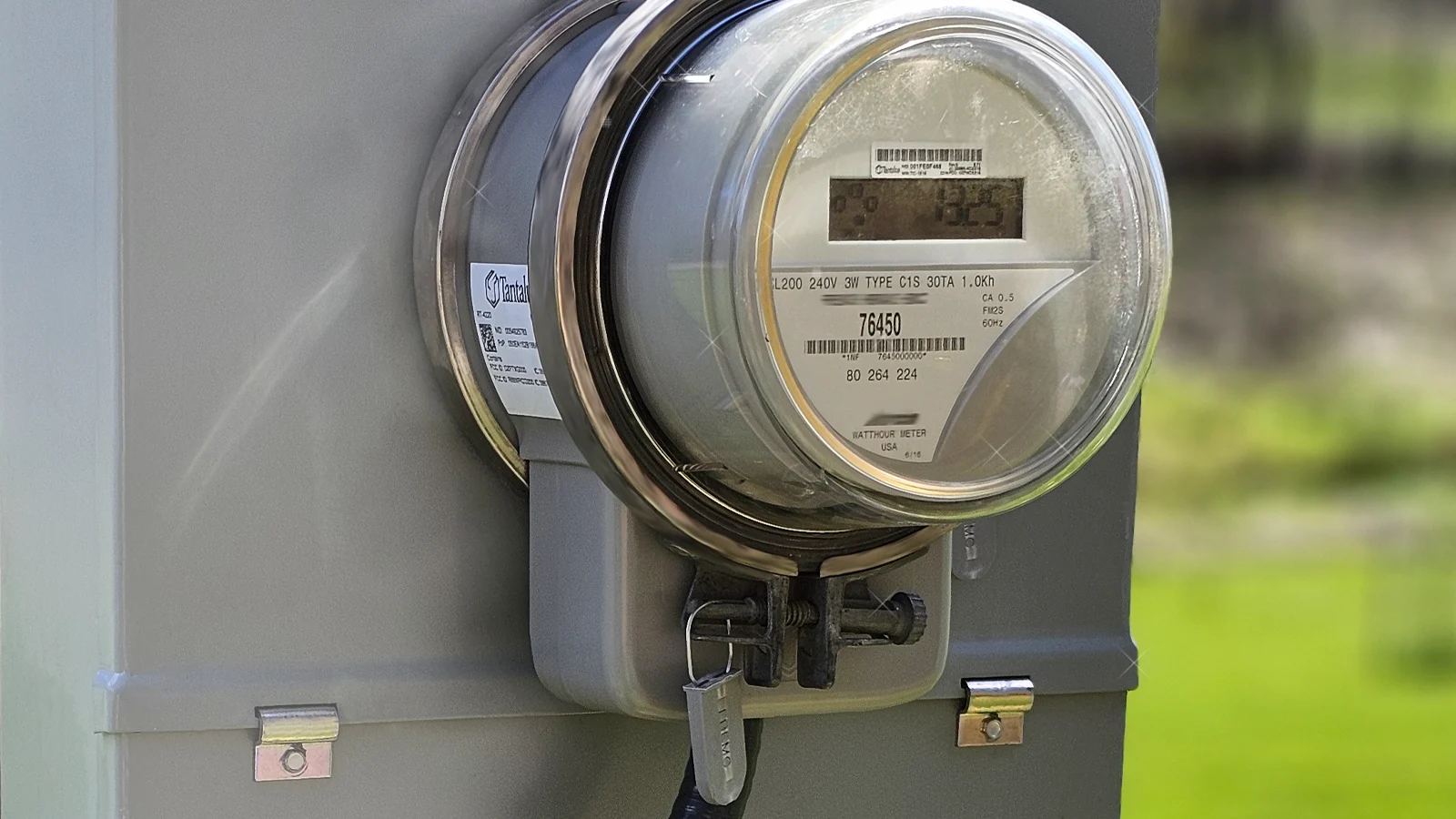

Tantalus is a technology company dedicated to helping utilities modernize their distribution grids by harnessing the power of data across all their devices and systems deployed throughout the entire distribution grid. We offer a grid modernization platform across multiple levels: intelligent connected devices, communications networks, data management, enterprise applications and analytics. Our solutions provide utilities with the flexibility they need to get the most value from existing infrastructure investments while leveraging advanced capabilities to plan for future requirements. Learn more at http://www.tantalus.com/.

FORWARD-LOOKING STATEMENTS

This news release includes information, statements, beliefs and opinions which are forward-looking, and which reflect current estimates, expectations and projections about future events, including, but not limited to, statements regarding the Offering generally, the terms thereof, the use of proceeds, the jurisdictions in which the Offering will be conducted, the filing of the offering materials and the satisfaction of the conditions of closing of the Offering, including the receipt, in a timely manner, of required approvals, the date of completion of the Offering, and other statements that contain words such as “believe,” “expect,” “project,” “should,” “seek,” “anticipate,” “will,” “intend,” “positioned,” “risk,” “plan,” “may,” “estimate” or, in each case, their negative and words of similar meaning. By its nature, forward-looking information involves a number of risks, uncertainties and assumptions that could cause actual results or events to differ materially from those expressed or implied by the forward-looking information. These risks, uncertainties and assumptions could adversely affect the outcome and financial effects of the plans and events described herein.

A more complete discussion of the risks and uncertainties facing the Company is disclosed under the heading “Risk Factors” in the Company’s Annual Information Form dated March 31, 2024, as well as the Company’s continuous disclosure filings with Canadian securities regulatory authorities available at www.sedarplus.ca.

In making the forward-looking statements in this news release, the Company has applied several material assumptions, including without limitation, assumptions regarding the Company receiving all required approvals, the amount to be raised, the use of the net proceeds of the Offering as announced or at all, the satisfaction or waiver of the conditions of closing of the Offering and the completion of the Offering on the expected terms.

Although the Company has attempted to identify important factors that could cause actual results or events to differ materially from those described in forward-looking statements, there may be other factors that cause results or events not to be as anticipated, estimated or intended. Readers should not place undue reliance on forward-looking information, which is based on the information available as of the date of this news release and the Company disclaims any intention or obligation to update or revise any forward-looking information contained in this new release, whether as a result of new information, future events or otherwise, unless required by applicable law. The forward-looking information included in this new release is expressly qualified in its entirety by this cautionary statement.

Contact Tantalus:

Jacquie Hudson

Marketing Communications Manager

613-552-4244 | jhudson@tantalus.com

Deborah Honig

Investor Relations

647-203-8793 | deborah@adcap.ca